The article below featured in the recently published Wessenden Briefing and has been reproduced by kind permission of Wessenden Marketing

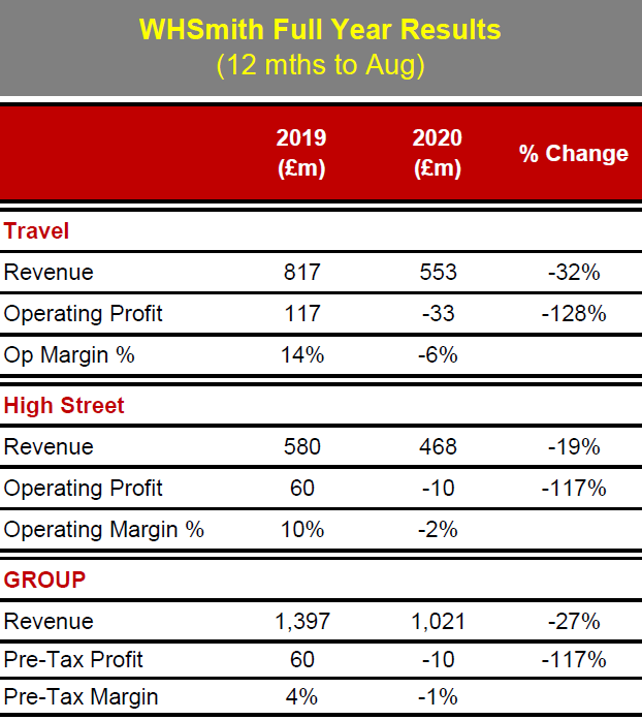

High St sales down -19% & Travel down -32%

Behind the topline Group figures, the difference between High St and Travel is stark, as the table shows. Travel’s like-for-likes are even worse at -43%.

Travel coming back from hibernation

A year ago, the division accounted for 66% of the Group’s profits, with mouth-watering 14% margins, and was growing quickly through an aggressive expansion and acquisition programme.

Now, it is limping along with sales running at around 40% of a year ago, waiting for travel restrictions to be eased. US Airports should come back faster than UK, but there are actually more concerns about UK Rail, where changing working practices are reshaping commuter patterns for good.

High Street clawing back & slimming down

WHS was managing the operation down, with a steadily declining topline year after year, but had started to reinvest in shop environments, which had become cramped and tatty. Margins were still double digit due to grinding cost control. Whilst Lockdown 1 saw only 203 stores of the total 558 estate open, Lockdown 2 sees HS fully open. And it needs to be to keep the cash flowing through the business. HS went back into profit in September.

- On top of 1,500 redundancies in August, HS has announced that a further 250 jobs will go as it permanently closes 25 outlets. Although it has driven property rents down by -45% during the year, contracts for 400 stores will come up for renewal over the next three years. It is likely that WHS will continually prune its store portfolio.

- What is clear from the magazine sales data (see Page 17 of the Wessenden Briefing – available FREE to Ace members see foot of this news item) is that magazines have been significantly underperforming other categories. Whereas total HS sales in October were running at -8% down YoY, the drop for magazines was –27%.

“ The views expressed in the article are those of Wessenden Marketing. WM provides a unique and independent analysis of the constant flow of news in our industry: newspapers & magazines; retail & subscription; print & digital. It helps you to make more informed decisions about how you run your business. wessendenbriefing is subscription-only, but you can see this complete issue free of charge as a special offer to ACE members by contacting Wessenden Marketing (info@wessenden.com).”